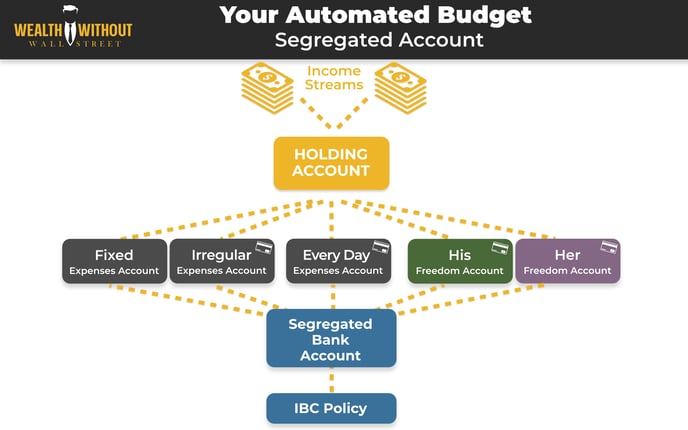

As you move cash through a policy - premium payments, policy loans, loan repayments, you will be using your bank to make this happen. Using tools like Your Automated Budget and Profit First to leverage bank accounts to help you with personal accounting as well as your bank's online bill pay to easily send cash as loan repayments or PUA rider premiums to your policy can help you manage your system.

One small additional step that can make a big difference in operating your system is using a segregated IBC checking or savings account. In other words, establishing a bank account alongside your Automated Budget or Profit First system where you receive cash from the policy and send cash to the policy.

Here are a couple of good uses of the segregated bank account:

- Reserving cash for your PUA premiums. As you filter cash through your budgeting and accounting system and set cash aside to store in your policy for your PUA premiums, having this bank account as a holding place before you make a PUA payment can help you keep track and not spend what is in your lifestyle accounts!

- Completing loan repayment schedules. You may finance the purchase of an education, equipment, asset, vacation, anything through your policy and set up a loan repayment schedule at a high interest rate. If you don't have existing loans against the policy you are going to pay back the loan against the policy before you complete your repayment schedule. You can complete the repayment schedule by depositing cash in this segregated account.

These are just a couple of basic uses of this account, but ultimately this is just a place where cash goes first as it comes to you against the policy via loan or a place where cash goes first before you send it off to the policy as a premium payment or loan repayment.

Refer to the IBC 201 course for a visual example of this segregated account used in the purchase of an asset.